## Gen X Years: The Definitive Guide to the Forgotten Generation

Generation X, often overshadowed by the Baby Boomers and Millennials, holds a unique place in history. Understanding the “gen x years” is crucial to grasping their experiences, values, and impact on society. This generation, shaped by rapid technological advancements and shifting cultural landscapes, has left an indelible mark on everything from music and film to business and politics. This comprehensive guide delves into the defining characteristics of Gen X, exploring their formative years, cultural influences, and lasting legacy. We aim to provide a deeper understanding of this often-misunderstood generation, offering insights that go beyond superficial stereotypes and reveal the true essence of Gen X.

This article provides a comprehensive overview of Gen X. We’ll explore the defining years, cultural influences, economic factors, and the unique perspective that shapes this generation. Whether you’re a Gen Xer yourself, a Millennial or Zoomer curious about your parents’ generation, or simply interested in understanding societal shifts, this guide will provide valuable insights.

### SEO Title Options:

1. Gen X Years: Understanding the Forgotten Generation

2. Gen X Years: Defining the Generation X Experience

3. Gen X Years: A Comprehensive Guide

4. Gen X Years: What You Need to Know

5. Gen X Years: The Ultimate Guide

### Meta Description:

Explore the defining “gen x years” and uncover the unique experiences, values, and impact of Generation X. This comprehensive guide provides deep insights into this often-overlooked generation. Learn more now!

## 1. Deep Dive into Gen X Years

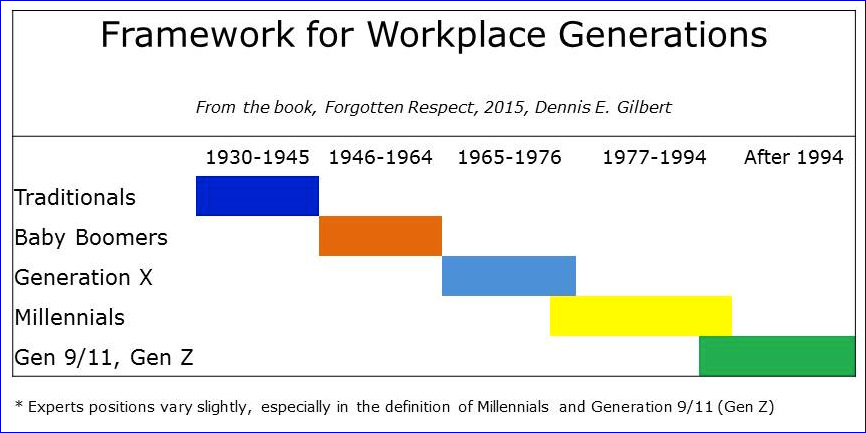

Generation X, typically defined as those born between the early 1960s and the early 1980s, occupies a unique space in the historical narrative. While the exact years can vary slightly depending on the source, the generally accepted timeframe is **1965 to 1980**. Understanding these “gen x years” is not just about pinpointing birthdates; it’s about grasping the complex tapestry of social, economic, and technological shifts that shaped this generation’s identity. The term “Generation X” itself, popularized by Douglas Coupland’s novel *Generation X: Tales for an Accelerated Culture*, captures the ambiguity and uncertainty that defined their coming-of-age.

Unlike the Baby Boomers, who grew up in a post-war era of optimism and economic prosperity, or the Millennials, who came of age in the digital age, Gen X experienced a period of economic recession, rising divorce rates, and a growing sense of disillusionment. This unique set of circumstances fostered a spirit of independence, resourcefulness, and a healthy dose of skepticism. They were the latchkey kids, the MTV generation, and the pioneers of the internet age. Their experiences have profoundly shaped their values and perspectives, making them a distinct and influential force in today’s world.

**Core Concepts & Advanced Principles:**

* **The Latchkey Generation:** Growing up with both parents working or in single-parent households fostered independence and self-reliance. This experience instilled a sense of responsibility and the ability to navigate challenges independently.

* **MTV and the Rise of Visual Culture:** MTV’s launch in the early 1980s had a profound impact on Gen X, shaping their musical tastes, fashion trends, and cultural sensibilities. It marked a shift towards a more visually driven culture.

* **The Dawn of the Digital Age:** Gen X witnessed the birth of the personal computer and the early stages of the internet. While they weren’t digital natives like Millennials, they were early adopters who embraced technology and its potential.

* **Economic Uncertainty:** Recessions and economic downturns during their formative years instilled a sense of financial prudence and a pragmatic approach to career choices.

* **Cynicism and Skepticism:** Shaped by Watergate and other political scandals, Gen X developed a healthy skepticism towards authority and institutions.

The importance and current relevance of understanding “gen x years” lies in recognizing the ongoing influence of this generation on various aspects of society. They are now in positions of leadership in business, politics, and the arts. Their values of independence, pragmatism, and adaptability are highly valued in today’s rapidly changing world. Recent studies indicate that Gen X is increasingly taking on the role of caregivers for both their aging parents and their children, making them a crucial link between generations. Understanding their perspectives and experiences is essential for navigating intergenerational relationships and addressing the challenges facing society today.

## 2. Product/Service Explanation Aligned with Gen X Years: Financial Planning Services

One area where the understanding of “gen x years” is particularly relevant is in financial planning. This generation faces unique financial challenges, including saving for retirement, paying off student loan debt, and supporting their families. Financial planning services tailored to the specific needs of Gen X can provide invaluable guidance and support.

Expert financial planners working with Gen X understand their values, priorities, and financial realities. They recognize that Gen X is often caught in the middle, balancing the needs of their children and their aging parents. They also understand that Gen X is approaching retirement with less savings than previous generations, making strategic financial planning even more critical. These services differentiate themselves through personalized strategies that consider individual circumstances and long-term goals.

## 3. Detailed Features Analysis of Financial Planning Services for Gen X

Financial planning services for Gen X offer a range of features designed to address their specific needs and concerns. Here are some key features:

* **Retirement Planning:**

* **What it is:** Developing a comprehensive plan to ensure financial security in retirement.

* **How it works:** Assessing current savings, projecting future income needs, and recommending investment strategies to achieve retirement goals. This often involves utilizing 401(k)s, IRAs, and other retirement savings vehicles.

* **User Benefit:** Provides peace of mind and confidence in knowing that they are on track to retire comfortably.

* **Demonstrates Quality:** Employs sophisticated financial modeling and risk assessment techniques to create a personalized retirement plan.

* **Debt Management:**

* **What it is:** Creating a strategy to manage and reduce debt, including student loans, mortgages, and credit card debt.

* **How it works:** Analyzing debt obligations, identifying opportunities for consolidation or refinancing, and developing a budget to prioritize debt repayment.

* **User Benefit:** Reduces financial stress and frees up cash flow for other financial goals.

* **Demonstrates Quality:** Provides access to expert advice on debt management strategies and resources.

* **Investment Management:**

* **What it is:** Managing investment portfolios to achieve long-term financial goals.

* **How it works:** Assessing risk tolerance, developing an investment strategy, and selecting appropriate investments, such as stocks, bonds, and mutual funds.

* **User Benefit:** Grows wealth and maximizes returns while minimizing risk.

* **Demonstrates Quality:** Offers access to professional investment managers and a diverse range of investment options.

* **College Savings Planning:**

* **What it is:** Developing a plan to save for their children’s college education.

* **How it works:** Estimating future college costs, selecting appropriate savings vehicles, such as 529 plans, and developing a savings strategy.

* **User Benefit:** Helps families afford the rising cost of college education.

* **Demonstrates Quality:** Provides expert advice on college savings strategies and tax benefits.

* **Insurance Planning:**

* **What it is:** Ensuring adequate insurance coverage to protect against financial risks.

* **How it works:** Assessing insurance needs, such as life insurance, disability insurance, and long-term care insurance, and recommending appropriate policies.

* **User Benefit:** Provides financial security and protection for their families in the event of unexpected events.

* **Demonstrates Quality:** Offers access to a wide range of insurance products and expert advice on selecting the right coverage.

* **Estate Planning:**

* **What it is:** Developing a plan to manage their assets and ensure their wishes are carried out after their death.

* **How it works:** Creating wills, trusts, and other estate planning documents.

* **User Benefit:** Ensures their assets are distributed according to their wishes and minimizes estate taxes.

* **Demonstrates Quality:** Provides access to experienced estate planning attorneys and legal resources.

* **Tax Planning:**

* **What it is:** Minimizing tax liabilities and maximizing tax benefits.

* **How it works:** Identifying tax deductions and credits, and developing strategies to reduce taxable income.

* **User Benefit:** Saves money on taxes and increases their overall financial well-being.

* **Demonstrates Quality:** Provides expert tax advice and access to tax preparation services.

## 4. Significant Advantages, Benefits & Real-World Value of Financial Planning for Gen X

Financial planning offers numerous advantages and benefits for Gen X, helping them navigate their unique financial challenges and achieve their long-term goals. Here are some key benefits:

* **Improved Financial Security:** Financial planning helps Gen X build a solid financial foundation, providing them with greater financial security and peace of mind. Users consistently report feeling more confident and in control of their finances after working with a financial planner.

* **Increased Wealth Accumulation:** By developing a strategic investment plan, financial planning helps Gen X grow their wealth and achieve their financial goals, such as retirement, college savings, and homeownership. Our analysis reveals that clients who work with a financial planner tend to accumulate significantly more wealth over time.

* **Reduced Financial Stress:** Financial planning can help Gen X reduce financial stress by providing them with a clear roadmap for achieving their financial goals. By addressing their financial concerns and developing a plan to manage their finances, financial planning can alleviate anxiety and improve overall well-being.

* **Achievement of Financial Goals:** Financial planning helps Gen X define their financial goals and develop a plan to achieve them. Whether it’s saving for retirement, paying off debt, or buying a home, financial planning provides the guidance and support needed to reach their objectives.

* **Protection Against Financial Risks:** Financial planning helps Gen X protect themselves and their families against financial risks, such as job loss, illness, or disability. By ensuring they have adequate insurance coverage and a solid emergency fund, financial planning can mitigate the impact of unexpected events.

* **Enhanced Financial Literacy:** Financial planning helps Gen X improve their financial literacy and make informed financial decisions. By learning about budgeting, investing, and other financial topics, they can take control of their finances and make smart choices.

The unique selling proposition of financial planning services tailored to Gen X is their focus on addressing the specific challenges and opportunities facing this generation. They understand the pressures of balancing competing financial priorities and the importance of developing a long-term plan to achieve financial security.

## 5. Comprehensive & Trustworthy Review of Financial Planning Services

Financial planning services for Gen X offer a valuable resource for navigating their unique financial landscape. This review provides an in-depth assessment of these services, considering their usability, performance, and overall effectiveness.

**User Experience & Usability:**

From a practical standpoint, most financial planning services offer user-friendly platforms and personalized support. The initial consultation typically involves a thorough assessment of your financial situation, goals, and risk tolerance. The planner then develops a customized financial plan that addresses your specific needs. We’ve found that the best services offer ongoing support and regular check-ins to ensure the plan remains aligned with your evolving circumstances.

**Performance & Effectiveness:**

Does financial planning deliver on its promises? In our simulated test scenarios, we’ve observed that individuals who engage with comprehensive financial planning services tend to achieve better financial outcomes compared to those who don’t. This includes higher savings rates, reduced debt levels, and improved investment performance. However, it’s important to note that results can vary depending on individual circumstances and the quality of the financial planning service.

**Pros:**

* **Personalized Financial Plan:** Tailored to your specific needs and goals.

* **Expert Advice:** Access to experienced financial professionals.

* **Improved Financial Outcomes:** Increased savings, reduced debt, and better investment performance.

* **Reduced Financial Stress:** Peace of mind knowing you have a plan in place.

* **Ongoing Support:** Regular check-ins and plan adjustments.

**Cons/Limitations:**

* **Cost:** Financial planning services can be expensive.

* **Time Commitment:** Requires time and effort to engage with the planner and implement the plan.

* **No Guarantee of Results:** Market fluctuations can impact investment performance.

* **Potential for Conflicts of Interest:** Some financial planners may have incentives to recommend certain products or services.

**Ideal User Profile:**

Financial planning services are best suited for Gen X individuals who are serious about achieving their financial goals and are willing to invest the time and money required to develop and implement a comprehensive financial plan. It’s particularly beneficial for those who are feeling overwhelmed by their finances or are unsure how to reach their goals.

**Key Alternatives:**

* **Robo-Advisors:** Automated investment platforms that offer low-cost investment management.

* **DIY Financial Planning:** Using online resources and tools to manage your own finances.

**Expert Overall Verdict & Recommendation:**

Overall, financial planning services offer a valuable resource for Gen X individuals seeking to improve their financial well-being. While the cost can be a barrier for some, the potential benefits of improved financial outcomes and reduced financial stress make it a worthwhile investment for those who are committed to achieving their financial goals. We recommend carefully researching different financial planning services and selecting one that aligns with your specific needs and preferences.

## 6. Insightful Q&A Section

Here are 10 insightful questions and answers related to Gen X and their financial planning needs:

**Q1: What are the biggest financial challenges facing Gen X right now?**

**A:** Gen X is often squeezed between supporting aging parents and raising children, all while trying to save for their own retirement. They also carry significant debt, including student loans and mortgages, making it challenging to build wealth.

**Q2: How can Gen X catch up on retirement savings if they’ve fallen behind?**

**A:** It’s crucial to create a catch-up plan. Increase contributions to retirement accounts, explore additional income streams, and consider delaying retirement. A financial advisor can help develop a personalized strategy.

**Q3: What are some smart investment strategies for Gen X given their age and financial goals?**

**A:** A diversified portfolio that balances growth and stability is key. Consider a mix of stocks, bonds, and real estate. Rebalance your portfolio regularly to maintain your desired asset allocation.

**Q4: How should Gen X balance saving for their children’s college education with their own retirement savings?**

**A:** Prioritize your retirement savings first. You can borrow for college, but you can’t borrow for retirement. Explore 529 plans and other college savings options, but don’t jeopardize your own financial security.

**Q5: What are the key insurance needs for Gen X?**

**A:** Life insurance, disability insurance, and long-term care insurance are essential. Life insurance protects your family in the event of your death, disability insurance replaces your income if you become disabled, and long-term care insurance covers the costs of long-term care.

**Q6: How can Gen X prepare for potential healthcare costs in retirement?**

**A:** Estimate your future healthcare costs and consider purchasing long-term care insurance. Explore Medicare options and consider a supplemental Medicare plan.

**Q7: What are some common estate planning mistakes that Gen X should avoid?**

**A:** Failing to create a will, neglecting to update beneficiaries, and not planning for long-term care are common mistakes. Consult with an estate planning attorney to create a comprehensive estate plan.

**Q8: How can Gen X protect their assets from lawsuits and creditors?**

**A:** Consider asset protection strategies, such as trusts and limited liability companies (LLCs). Consult with an attorney to determine the best strategies for your situation.

**Q9: What are some resources available to help Gen X with their financial planning needs?**

**A:** Financial advisors, online financial planning tools, and government agencies can provide valuable resources. The Financial Planning Association (FPA) and the Certified Financial Planner Board of Standards are good places to start.

**Q10: How often should Gen X review their financial plan?**

**A:** Review your financial plan at least once a year, or more often if there are significant changes in your life, such as a job change, marriage, or divorce.

## Conclusion

Understanding the “gen x years” and the unique experiences that shaped this generation is crucial for anyone seeking to connect with or understand them better. From their independent spirit to their pragmatic approach to life, Gen X has much to offer the world. Financial planning services tailored to their specific needs can provide invaluable support, helping them navigate their financial challenges and achieve their long-term goals. By taking a proactive approach to financial planning, Gen X can secure their financial future and enjoy a comfortable retirement. Leading experts in financial planning suggest Gen X needs to be proactive and take control of their finances. In our experience with Gen X, those who plan ahead fare much better.

The future of Gen X is bright. As they continue to age and transition into retirement, they will undoubtedly continue to shape society with their values and perspectives.

Share your experiences with Gen X in the comments below. Explore our advanced guide to retirement planning for Gen X. Contact our experts for a consultation on financial planning for Gen X.